301

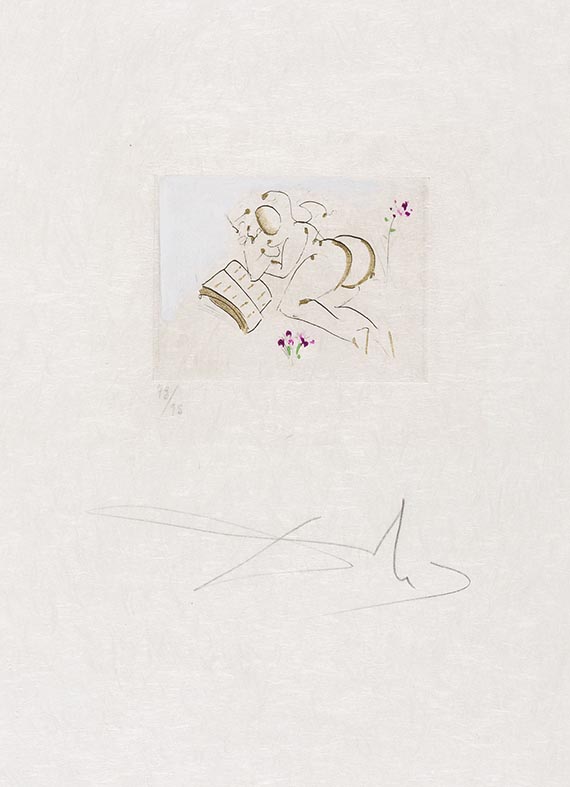

Salvador Dalí

Petites nus (from Apollinaire), 1970.

Estimate: € 4,500 / $ 4,815

Salvador Dalí

Petites nus (from Apollinaire). [Paris Éditions Argillet 1970].

Vollständige Serie der separat editierten 8 kolorierten Orig.-Radierungen zu den Poèmes Secrets von Apollinaire, erschienen in 95 Exemplaren auf Japan.

Dalìs Illustrationen zu Poèmes Secrets von Apollinaire erschienen 1967 in Paris, ausgestattet mit 18 Radierungen, davon 10 ganzseitig und 8 als Vignetten. "The eight vignettes were published in 1972 as Petites Nus . The paper bears the blind stamp Dalí" (Field). - Sämtliche Blätter mit großzügiger Signatur von Dalí, numeriert und mit Signatur-Blindstempel.

EINBAND: Lose Graphiken unter Passepartout punktuell montiert. - ILLUSTRATION: Folge mit 8 kolorierten, signierten und numierierten Orig.-Radierungen von S. Dalí. Blattformat 38 : 28 cm. - ZUSTAND: Vereinzelt min. fleckig, im Passepartoutausschnitt gering lichtrandig. - PROVENIENZ: Prviatsammlung Paris.

LITERATUR: Michler/Löpsinger 199-206. - Field 72-4.

1 von 95 copies on japon. Complete set of the separatly pushlished vignettes of Apollinaire's "Poemes Secrets". With 8 colored orig. etchings, signed, numered and with artist blind stamps. - Matted. - Occasionally minim. stained, with slight mat burn.

Petites nus (from Apollinaire). [Paris Éditions Argillet 1970].

Vollständige Serie der separat editierten 8 kolorierten Orig.-Radierungen zu den Poèmes Secrets von Apollinaire, erschienen in 95 Exemplaren auf Japan.

Dalìs Illustrationen zu Poèmes Secrets von Apollinaire erschienen 1967 in Paris, ausgestattet mit 18 Radierungen, davon 10 ganzseitig und 8 als Vignetten. "The eight vignettes were published in 1972 as Petites Nus . The paper bears the blind stamp Dalí" (Field). - Sämtliche Blätter mit großzügiger Signatur von Dalí, numeriert und mit Signatur-Blindstempel.

EINBAND: Lose Graphiken unter Passepartout punktuell montiert. - ILLUSTRATION: Folge mit 8 kolorierten, signierten und numierierten Orig.-Radierungen von S. Dalí. Blattformat 38 : 28 cm. - ZUSTAND: Vereinzelt min. fleckig, im Passepartoutausschnitt gering lichtrandig. - PROVENIENZ: Prviatsammlung Paris.

LITERATUR: Michler/Löpsinger 199-206. - Field 72-4.

1 von 95 copies on japon. Complete set of the separatly pushlished vignettes of Apollinaire's "Poemes Secrets". With 8 colored orig. etchings, signed, numered and with artist blind stamps. - Matted. - Occasionally minim. stained, with slight mat burn.

301

Salvador Dalí

Petites nus (from Apollinaire), 1970.

Estimate: € 4,500 / $ 4,815

Buyer's premium, taxation and resale right compensation for Salvador Dalí "Petites nus (from Apollinaire)"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer prices up to € 200,000: 32 % buyer's premium

Hammer prices above € 200,000: for the share up to € 200,000: 32%, for the share above € 200,000: 27% buyer's premium

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer prices up to € 200,000: 25 % buyer's premium plus statutory sales tax Hammer prices above € 200,000: for the share up to € 200,000: 25%, for the share above € 200.000: 20% buyer's premium, each plus statutory sales tax

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer prices up to € 200,000: 32 % buyer's premium

Hammer prices above € 200,000: for the share up to € 200,000: 32%, for the share above € 200,000: 27% buyer's premium

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer prices up to € 200,000: 25 % buyer's premium plus statutory sales tax Hammer prices above € 200,000: for the share up to € 200,000: 25%, for the share above € 200.000: 20% buyer's premium, each plus statutory sales tax

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 301

Lot 301